Home / Investors

NOTE

This Is Not An Offer To Sell Securities Of Symbinas Pharmaceuticals Inc.

Click below to view Executive Summary presentation:

Symbinas NC Executive Summary Jan 2022

There is a crisis in the drug development for Concussion and Traumatic Brain Injury (TBI)

THE OPPORTUNITY

Symbinas’ strategy provides rapid and innovative drugs with safety-proven molecules to deliver life-changing solutions – in record time, at minimum cost and with lower risk

TBI Global Impact

Currently impacting over 50 million lives globally. Huge health and financial impact, costing $400B EACH year.

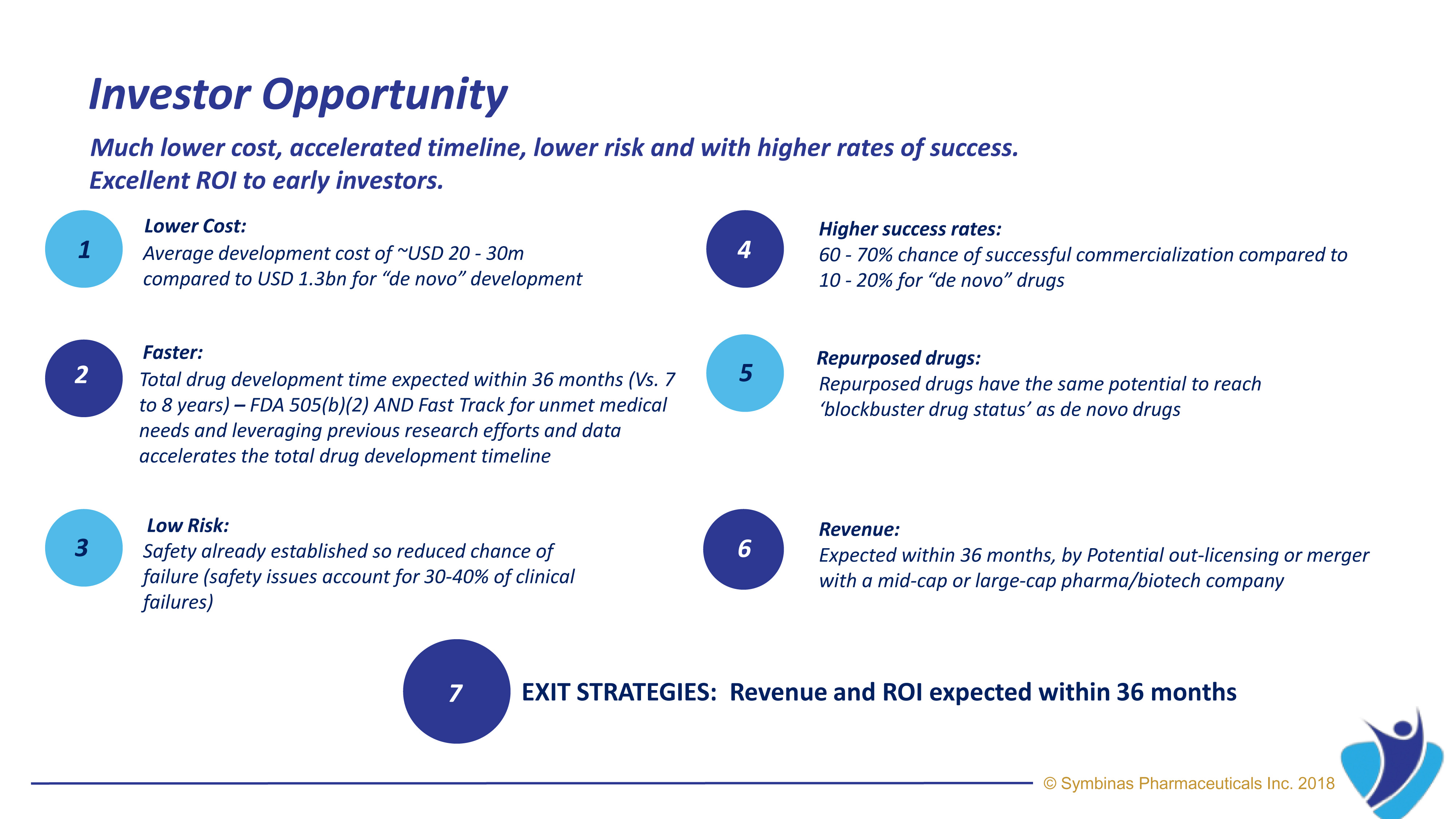

Lower

Cost

Average development cost of under $50M by using already-known molecules compared to more than $1B for “de novo” drug development.

Higher

ROI

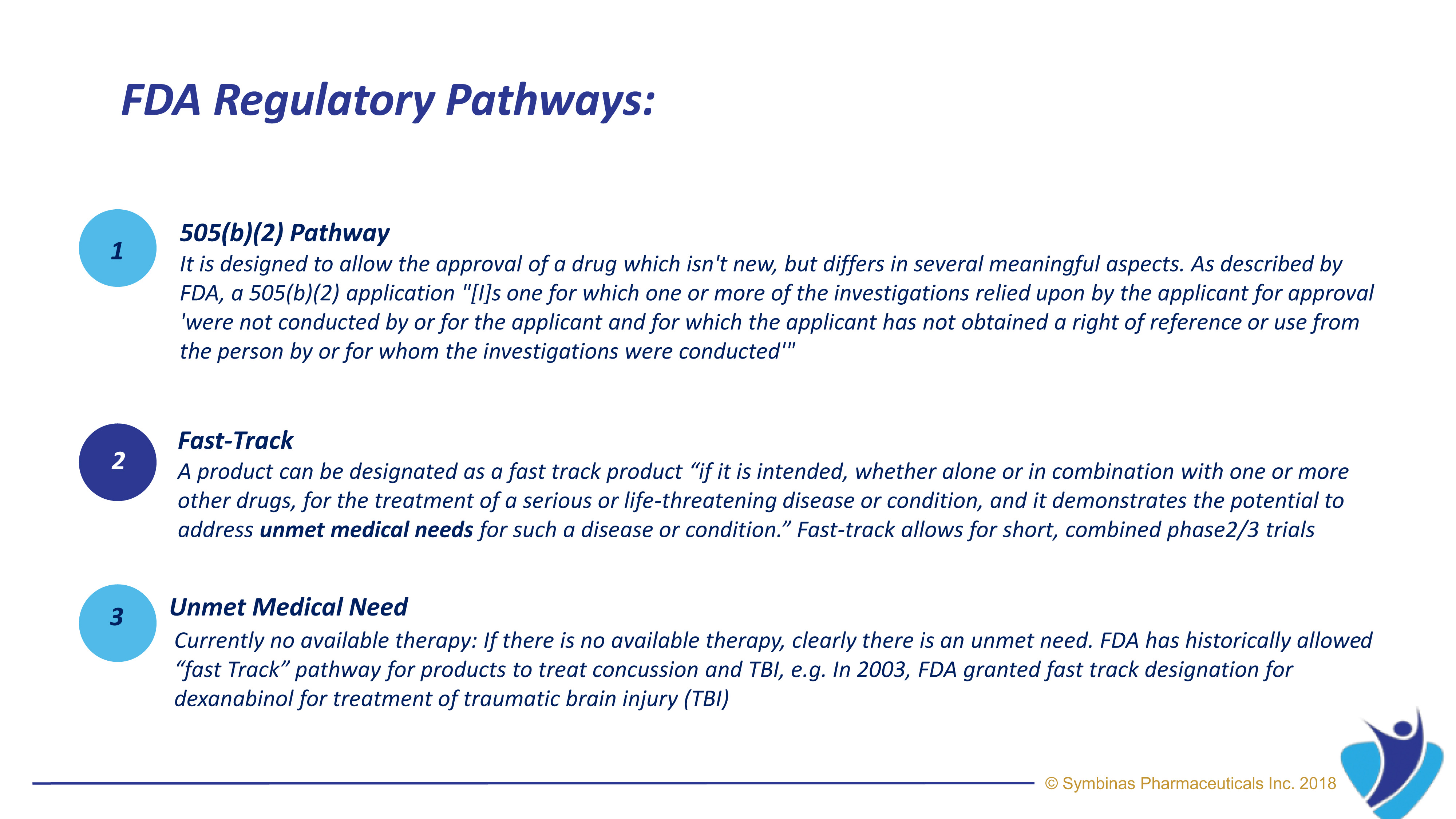

FDA’s expedited pathways and proven safety profile increase the likelihood of success and thus substantial return on investment.

Lower Risk of Failure

Already-know molecules have been safety established, thus lowering the chance of failure (safety issues account for 30-40% of clinical failures).

Faster to Market

With FDA’s accelerated Fast Track pathway, expected target date for SMB-603 for TBI is within 24 to 36 months*

Expect high ROI for early investors. *

Currently, there are no approved drugs to treat brain damage from TBI

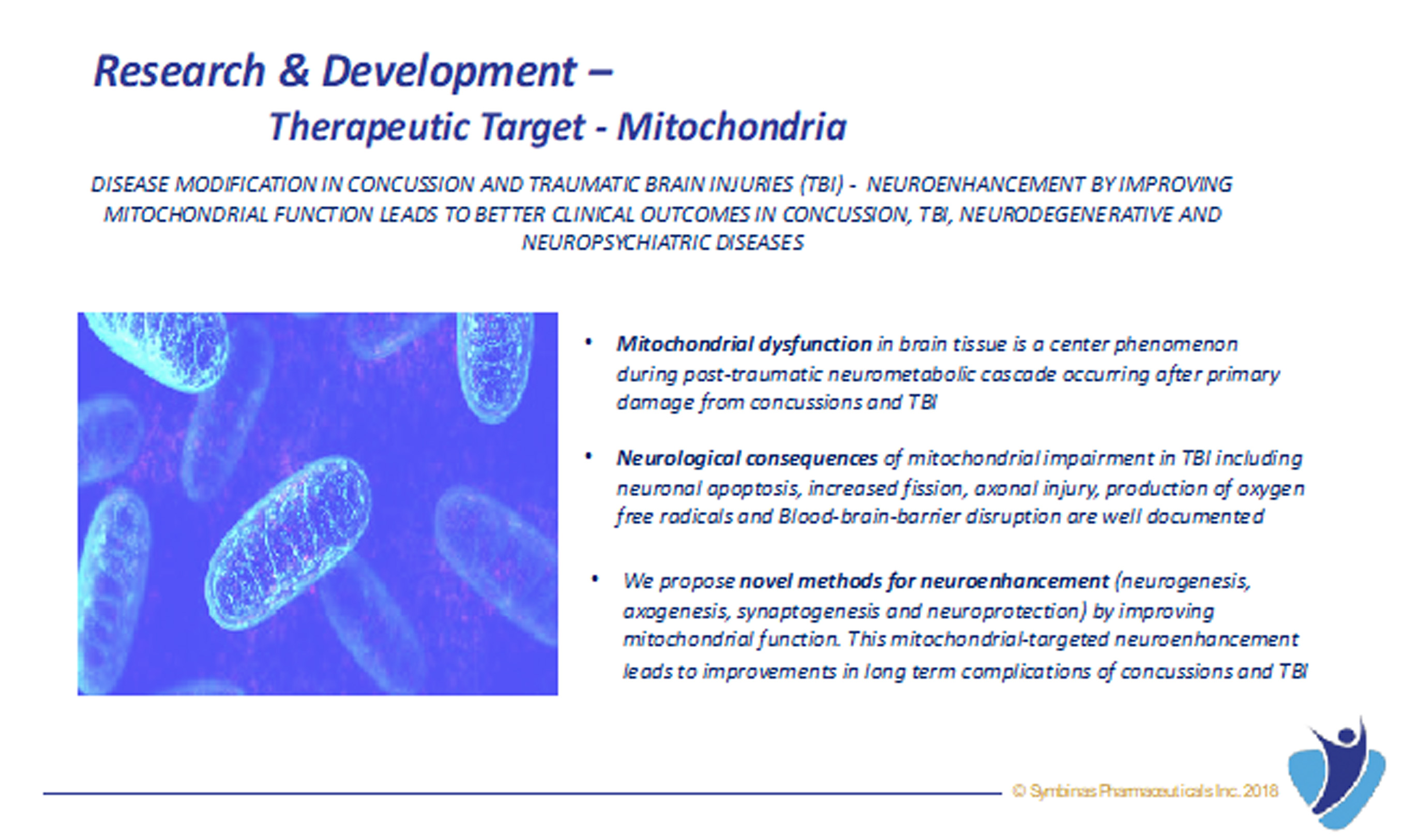

Symbinas Pharmaceuticals Inc. (“Symbinas”) is developing therapeutics for Concussion and TBI. Its lead drug product, SMB-603, is in clinical development and has US Food and Drug Administration (FDA) approval target dates of 24 – 36 months by utilizing FDA’s unique Fast-Track pathway for unmet medical needs.

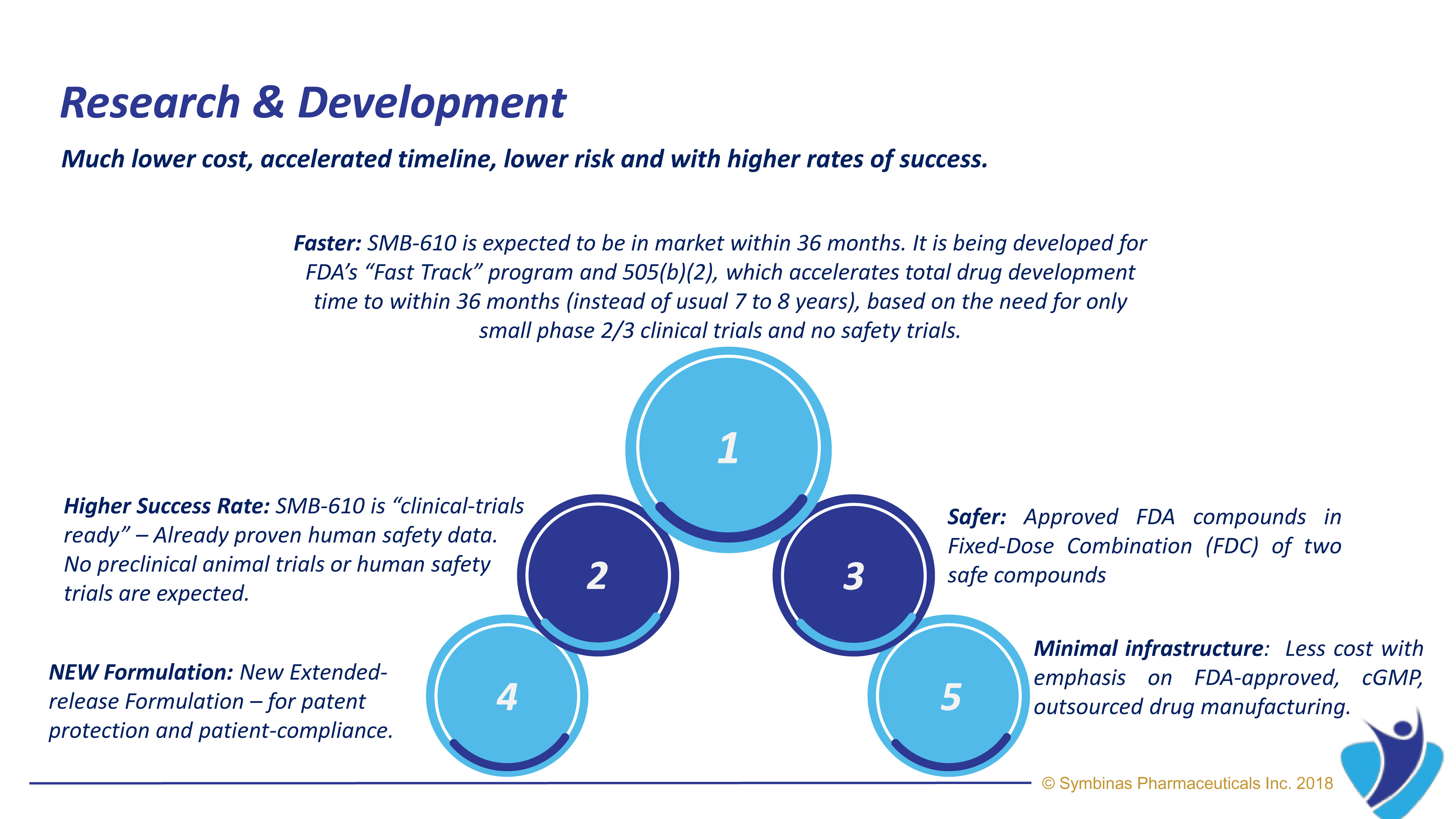

When compared to most healthcare investments, SMB-603 and SMB-710 drug candidates costs much less, takes less time to market, has no safety issues and has higher chance of success in clinical trials.

It provides much higher ROI and chances of success.

Key advantages include Products based on strong scientific evidence, Pipeline of three potential treatments with relatively fast introduction to the market with FDA Fast-Track pathway, Addressing a global market with unmet medical needs and large potential and Strong Management and Scientific Teams.

Drug Development and Commercialization:

- Partnerships established with world-class drug development vendors – IQVIA, Patheon, ProPharma

- Pre-formulation for Intravenous drug is starting

- Partnerships established with major U.S. medical centers to conduct clinical trials

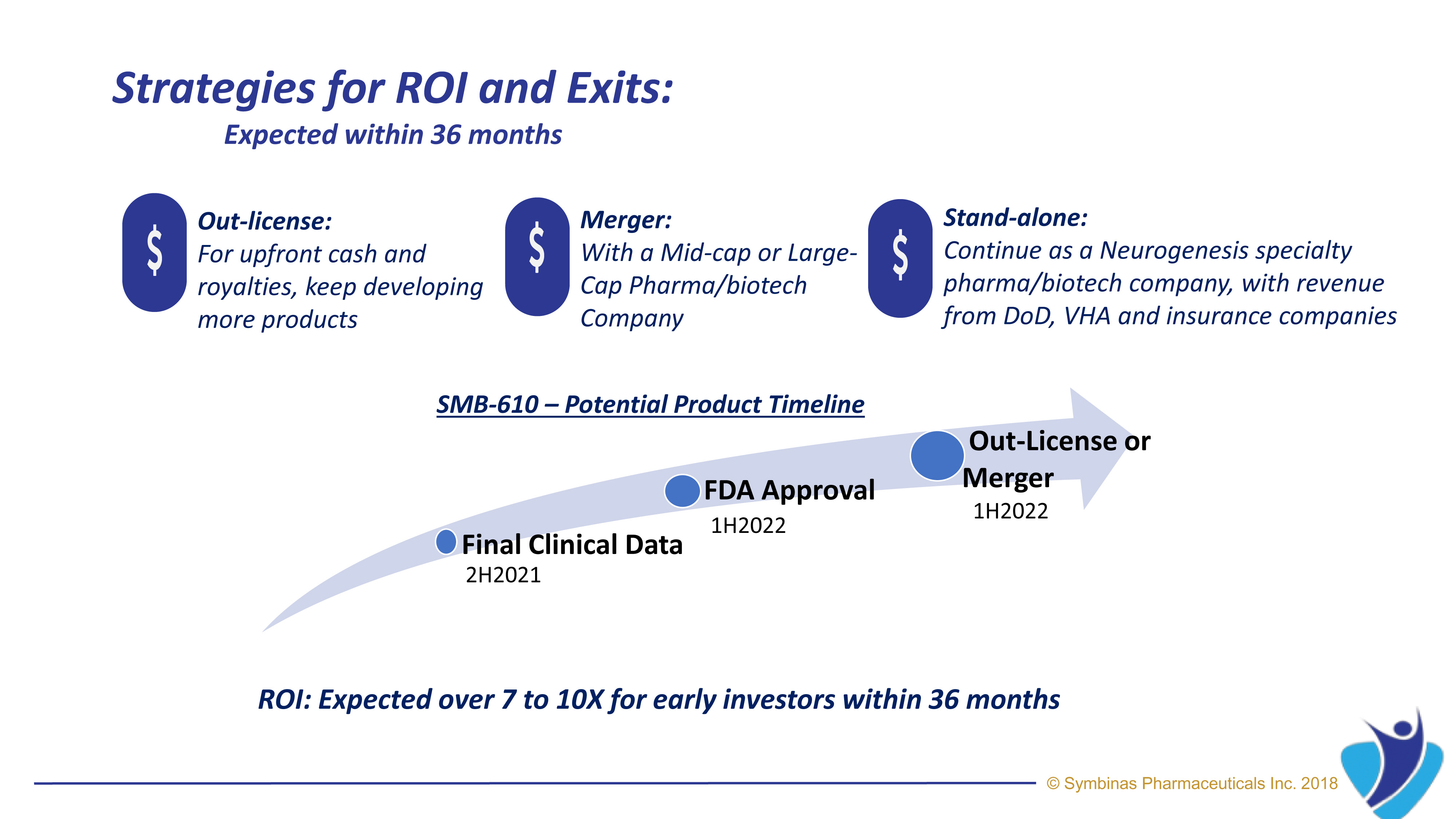

- Planned for Out-Licensing at appropriate time

- Minimal infrastructure with proven contractor approach to manufacturing, regulatory and clinical

THE INVESTMENT

Financing Details

Seed Financing:

- Founder seed funded the company

- Funds invested over past two years for corporate development, consultants, intellectual property, scientific milestones and legal counsels

- Company has NO debt

Current Series-A Raise:

- To finalize formulation development and manufacture intravenous drug to conduct clinical phase-I/II Fast Track trial with intravenous SMB-603

- ROI expected in less than 24 months

- Timing: would like to close in next 90 -120 days

Next raise:

- For additional Clinical Studies as required and for Commercialization. Several options are already being explored including Institutional raise, Regulation A+ under JOBS Act and via M&A target.